Navigating the Ontario Real Estate Landscape: A Broker’s Guide to Strategic Market Research

Are you contemplating the sale of your commercial property or investment building in Ontario, Canada? Before embarking on this pivotal journey, we must delve into the intricate details of our local market conditions and trends. Beyond the traditional “For Sale” sign, the key to a successful deal lies in having a meticulously crafted roadmap that guides you through the nuances of Ontario’s real estate landscape.

As a seasoned real estate broker practicing in Ontario, I understand the significance of local market research. It’s not merely about selling a property but strategically positioning it in a competitive market. Let’s explore strategic approaches to research your local market conditions and trends:

1. Realtor Consultation: Unlocking Ontario’s Real Estate Insights

In the dynamic world of Ontario’s commercial and investment real estate, consulting with a knowledgeable Realtor is akin to having access to a treasure trove of strategic insights. Our province’s real estate market has unique dynamics, and a seasoned Realtor becomes your trusted guide through the intricacies of commercial property transactions.

Investors in Ontario benefit significantly from Realtor consultations. They gain access to information crucial for navigating the nuances of commercial property transactions, allowing them to identify the most opportune moments for investment.

2. Online Real Estate Platforms: Ontario’s Virtual Hub for Property Data

Online platforms, such as local Multiple Listing Services (MLS), Costar, Altus, ICIWorld and prominent real estate websites, serve as Ontario’s virtual hub for gathering essential information on commercial properties. These platforms offer a comprehensive overview of recent property sales, current listings, and market trends specific to our province.

Leveraging these platforms provides investors with information and strategic advantage, enabling well-informed decisions that contribute to success in Ontario’s dynamic real estate market.

3. Attend Ontario Real Estate Events: Networking in the Heart of the Market

Attending local real estate events in Ontario is like stepping into an exclusive networking opportunity focused on our unique market. These events bring together professionals and investors to discuss trends and opportunities in the commercial property sector within the province.

Participating in these events provides firsthand insights that go beyond online information. It’s an opportunity to meet and connect with local real estate experts and fellow investors, gaining valuable knowledge that can lead to successful investments in Ontario.

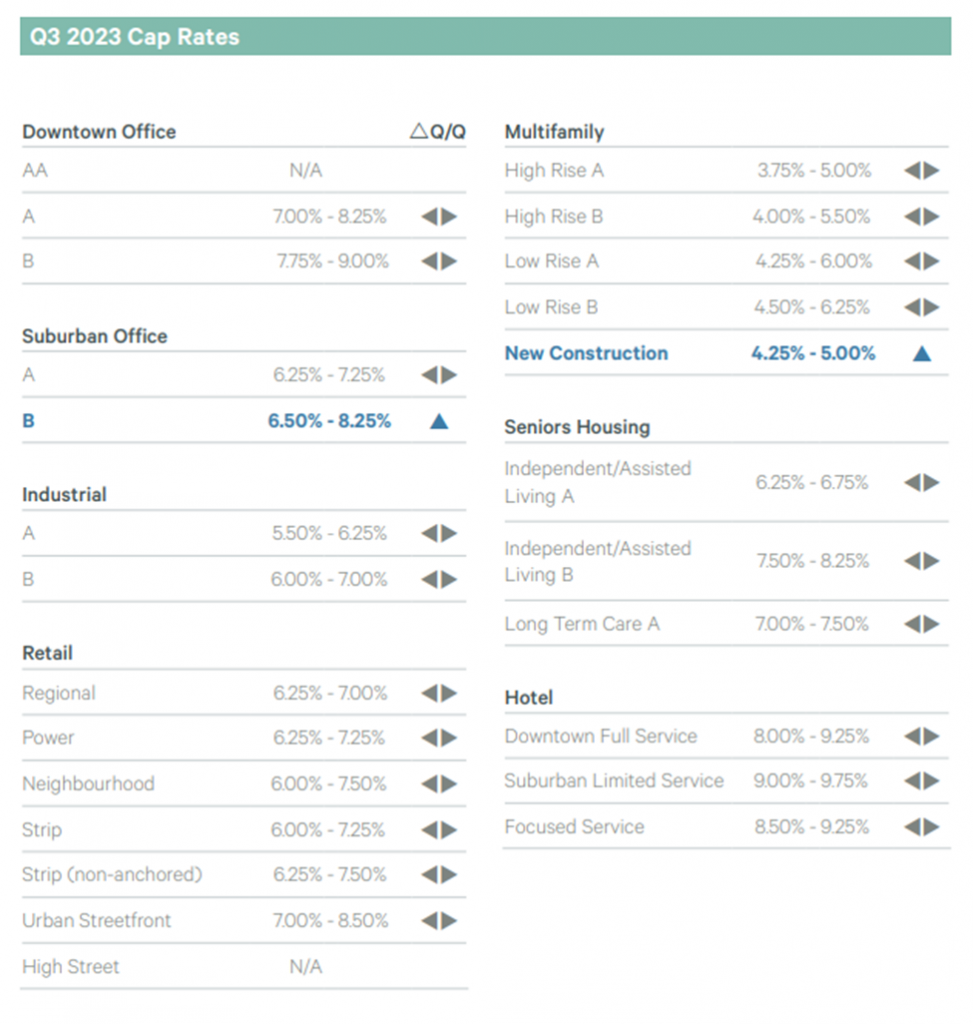

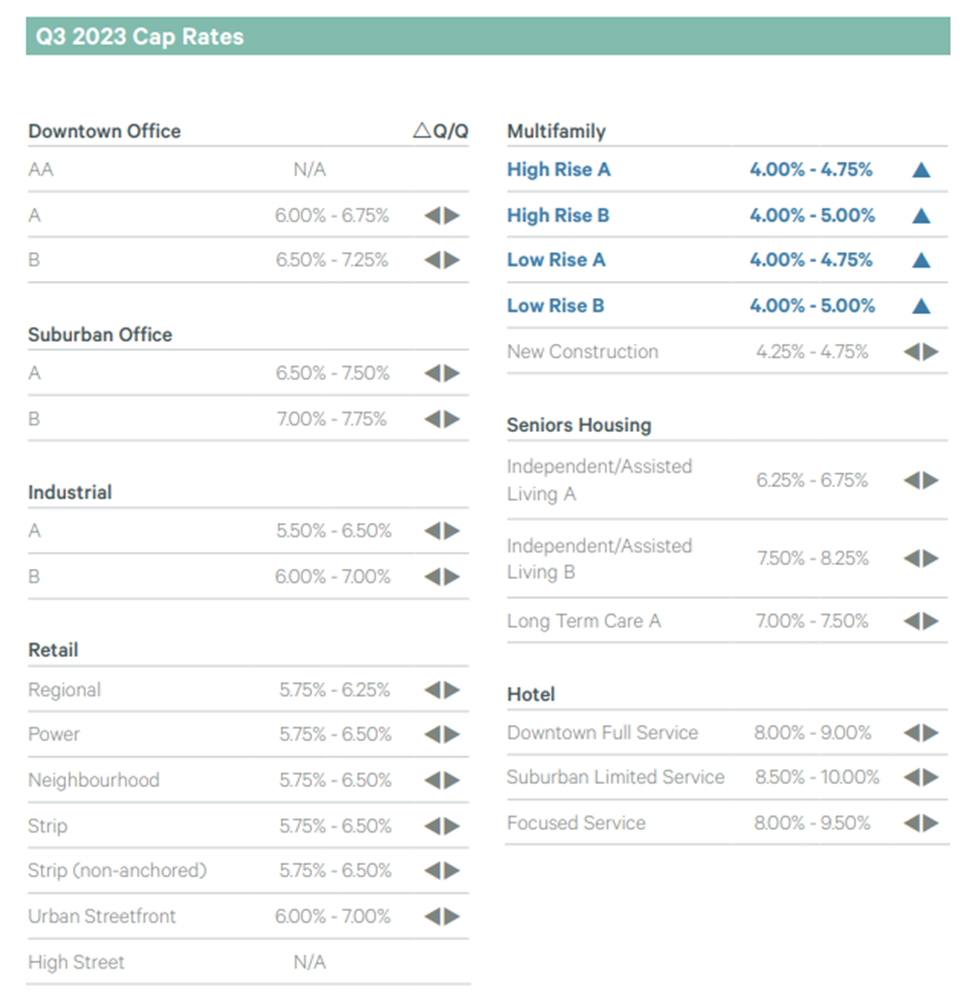

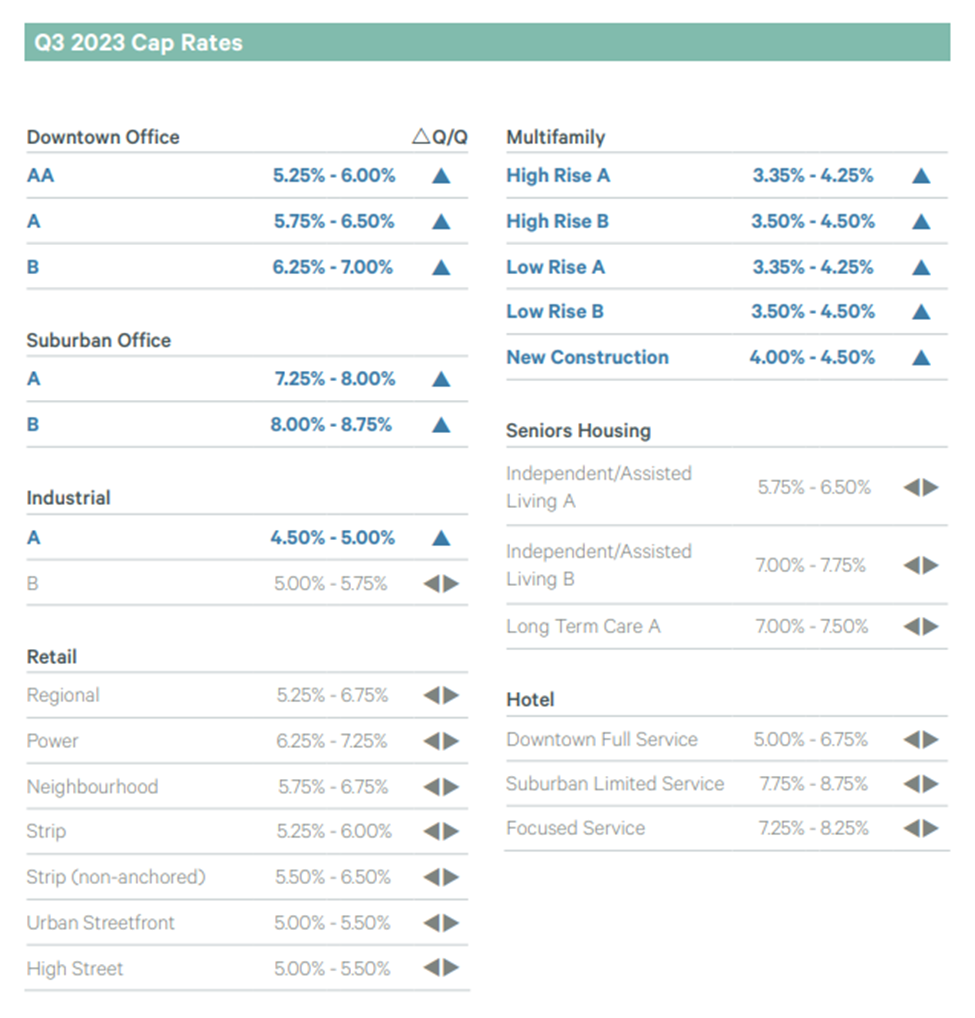

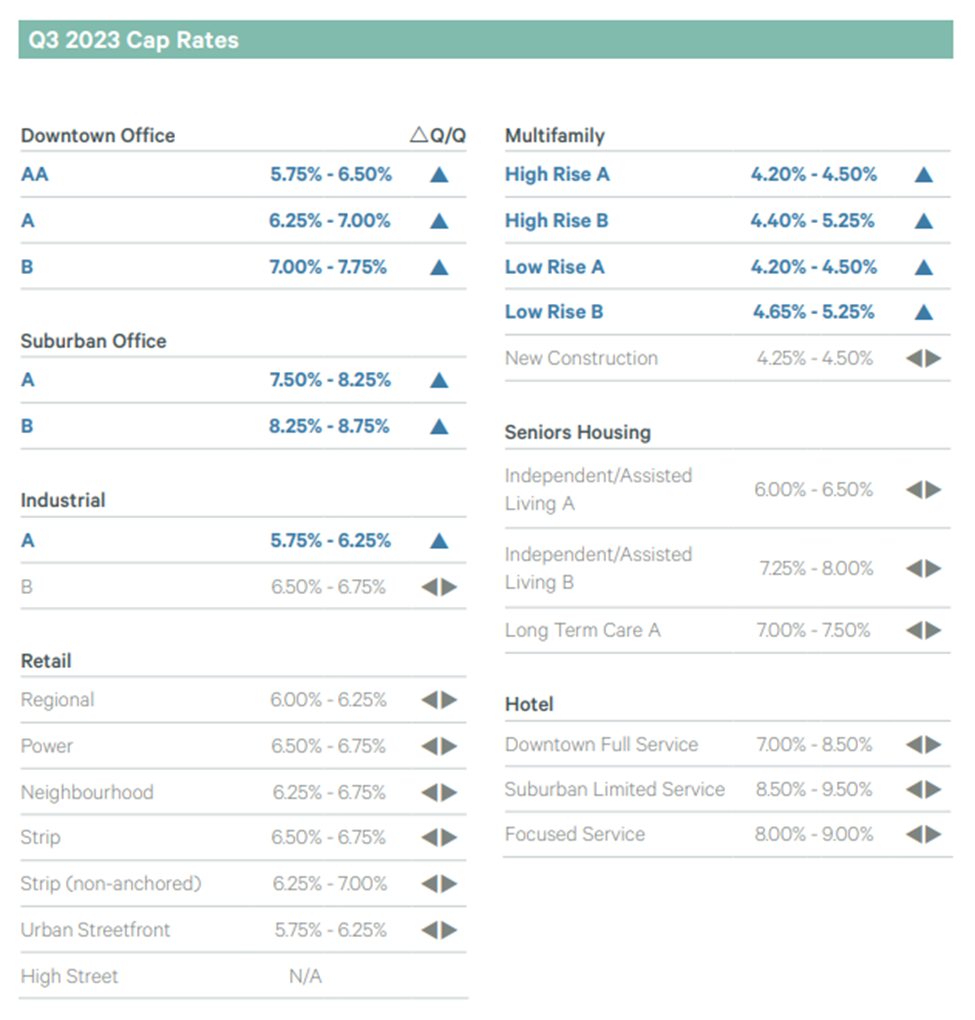

4. Review Ontario Housing Reports: Equipping Yourself with Provincial Insights

Reviewing local housing reports specific to Ontario equips investors with crucial information about the demand for different types of buildings, emerging investment opportunities, and the market’s overall health. It’s akin to having a strategic playbook tailored to Ontario’s real estate landscape, guiding investors through the complexities of commercial ventures.

5. Community Surveys and Feedback: Tapping into Ontario’s Collective Wisdom

Engaging in community surveys and seeking feedback becomes a strategic tool for understanding the intricate dynamics of Ontario’s buildings and investments. This process offers valuable insights into preferences, needs, and potential opportunities in the commercial property landscape. It’s like tapping into the collective wisdom of local stakeholders, ensuring that commercial properties align with the aspirations and requirements of the Ontario community.

In conclusion, successfully selling a commercial property or investment building in Ontario demands a nuanced understanding of local market conditions and trends. As a real estate broker practicing in this vibrant province, I emphasize the need for a personalized roadmap rooted in detailed research.

Leveraging Realtor consultations for strategic insights, exploring online real estate platforms for a comprehensive market overview, and attending local real estate events for exclusive insights provide investors and property owners in Ontario with essential tools. Reviewing local housing reports and soliciting community surveys and feedback contribute to a holistic approach, ensuring that commercial properties stand out and thrive in the competitive Ontario landscape.

Ready to navigate the complexities of Ontario’s commercial real estate market? Contact me for a personalized consultation, and let’s shape your success story together. Your strategic move begins here in the heart of Ontario’s real estate landscape.